Enhancing Effectiveness with the Commercial Registration Electronic System for Company Formation

Enhancing Effectiveness with the Commercial Registration Electronic System for Company Formation

Blog Article

Browsing the Complex World of Firm Formation: Insights and Approaches

Starting the journey of establishing a company can be a complicated job, especially in a landscape where laws are constantly developing, and the risks are high. As business owners laid out to browse the detailed globe of business formation, it comes to be important to gear up oneself with a deep understanding of the detailed nuances that specify the process. From picking the most ideal organization structure to making sure strict lawful compliance and creating effective tax obligation planning techniques, the course to creating an effective company entity is riddled with intricacies. By unraveling the layers of ins and outs and leveraging informative methods, business owners can lead the way for a solid structure that establishes the stage for future growth and sustainability.

Organization Structure Choice

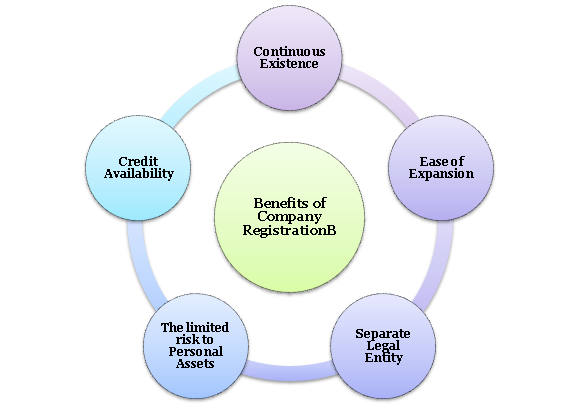

In the world of firm formation, the crucial decision of picking the appropriate service framework lays the foundation for the entity's lawful and functional structure. The option of organization framework significantly affects different facets of the organization, consisting of taxation, responsibility, administration control, and compliance needs. Business owners need to carefully assess the offered choices, such as sole proprietorship, partnership, restricted obligation business (LLC), or firm, to identify the most ideal structure that straightens with their service goals and situations.

One usual framework is the sole proprietorship, where the business and the proprietor are taken into consideration the exact same legal entity - company formation. This simpleness enables ease of formation and complete control by the owner; however, it also involves unrestricted personal responsibility and prospective difficulties in raising capital. Collaborations, on the other hand, entail two or even more people sharing profits and losses. While collaborations supply shared decision-making and resource merging, companions are directly liable for business's commitments and financial obligations. Understanding the nuances of each company framework is crucial in making an informed decision that sets a solid foundation for the business's future success.

Legal Compliance Essentials

With the structure of an ideal company structure in area, ensuring lawful conformity basics ends up being extremely important for guarding the entity's procedures and preserving governing adherence. Legal conformity is critical for companies to operate within the limits of the legislation and prevent lawful issues or prospective fines.

To ensure lawful conformity, companies need to on a regular basis review and update their plans and procedures to mirror any adjustments in laws. It is likewise necessary to inform staff members regarding compliance demands and provide training to alleviate threats. Looking for legal advise or conformity experts can additionally aid companies browse the intricate legal landscape and keep up to date with progressing laws. By prioritizing lawful compliance fundamentals, services can build a strong structure for lasting growth and long-term success.

Tax Preparation Factors To Consider

In addition, tax obligation planning should encompass techniques to take benefit of readily available tax obligation credit histories, reductions, and rewards. By purposefully timing income and expenses, businesses can possibly reduce their taxable income and overall tax burden. It is additionally important to remain notified about modifications in tax laws that may impact business, adjusting techniques accordingly to remain tax-efficient.

Additionally, international tax preparation factors to consider may arise for companies running across borders, entailing intricacies such as transfer prices and foreign tax obligation credit reports - company formation. Seeking guidance from tax obligation specialists can help navigate these intricacies and develop a comprehensive tax strategy customized to the business's needs

Strategic Financial Monitoring

Tactically managing funds is a fundamental element of steering a company in the direction of sustainable development and profitability. Efficient financial monitoring includes a comprehensive strategy to supervising a firm's cashes, investments, and total financial health and wellness. One crucial element of critical financial administration is budgeting. By producing detailed budget plans that straighten with the firm's goals and purposes, businesses can assign sources successfully and track efficiency against monetary targets.

An additional vital facet is capital management. Monitoring money inflows and discharges, managing capital efficiently, and making sure enough liquidity are important for the day-to-day operations and lasting stability of a business. In addition, critical economic administration includes risk assessment and reduction techniques. By determining financial threats such as great post to read market volatility, credit history risks, or regulatory adjustments, firms can proactively carry out steps to safeguard their economic stability.

Additionally, financial reporting and evaluation play an essential function in critical decision-making. By producing exact financial reports and performing comprehensive analysis, organizations can acquire beneficial insights into their monetary performance, recognize areas for enhancement, and make educated strategic choices that drive sustainable growth and productivity.

Growth and Growth Approaches

To drive a company in the direction of increased market visibility and earnings, critical development and growth approaches need to be carefully developed and applied. One reliable method for development is diversification, where a business goes into brand-new markets or deals brand-new products or services to Full Report reduce risks and take advantage of on arising opportunities. It is vital for companies to carry out comprehensive market research study, economic analysis, and threat analyses before embarking on any type of development technique to make sure sustainability and success.

Verdict

To conclude, navigating the complexities of firm formation requires mindful factor to consider of company framework, lawful conformity, tax preparation, financial management, and development methods. By tactically selecting the ideal company framework, making certain lawful compliance, intending for taxes, taking care of financial resources effectively, and carrying out development methods, companies can establish themselves up for success in the competitive service environment. It is essential for businesses to come close to firm formation with a strategic and detailed state of mind to achieve long-term success.

In the realm of firm formation, the crucial choice of choosing the suitable organization structure lays the structure for the entity's legal and functional framework. Entrepreneurs need to carefully assess the available choices, such as single proprietorship, partnership, limited liability business (LLC), or corporation, to identify the most appropriate framework that straightens with their organization goals and scenarios.

By developing detailed budgets that line up with the business's objectives and purposes, companies can assign resources effectively and track efficiency versus financial targets.

In final thought, browsing the complexities of business formation needs cautious consideration of service framework, legal conformity, tax obligation preparation, economic monitoring, and development approaches. By purposefully picking the appropriate organization framework, making certain lawful compliance, planning for tax obligations, taking care of funds properly, and carrying out development techniques, business can establish themselves up for success in the competitive company environment.

Report this page